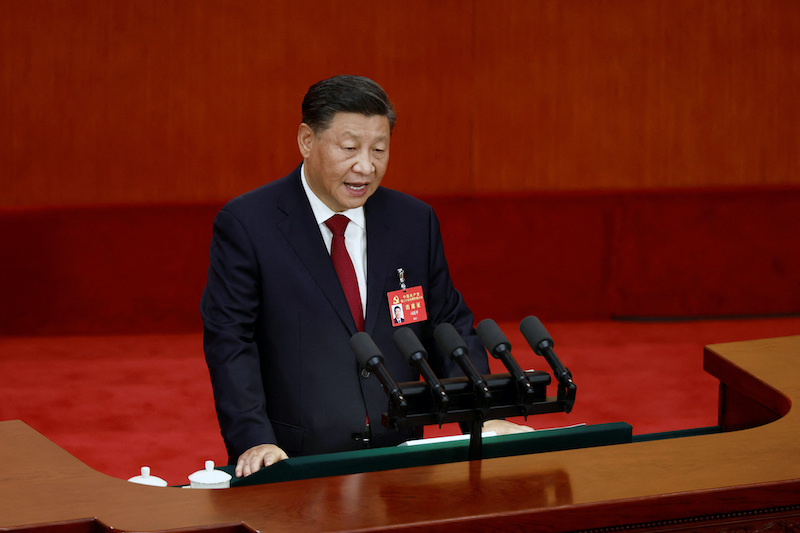

President Xi Jinping’s call for China to achieve self-reliance in technology – which featured prominently in his work report at the launch of the Communist Party’s Congress – suggests Beijing will not only ramp up spending but could take a whole new approach, especially in regard to computer chips.

Analysts said Xi’s eagerness to “win the battle” in core technologies could mean that China will overhaul its approach to boost its tech sector, with more state spending and intervention to counter US export restrictions and tech bans.

China has prioritised high technology at the top of its economic policies, they said.

Achieving self-reliance in technology was mentioned four times by Xi in his full work report at the start of the five-yearly Congress, versus none in 2017. And the term “technology” was referred to 40 times, up from 17 times in the report from the 2017 congress.

While the report did not mention any other countries or specific sectors for that goal, it comes days after Washington imposed sweeping new regulations aimed at undermining China’s efforts to develop its own chip industry.

HSBC analysts said their takeaway was that increased spending in China, particular in STEM (science, technology, engineering and maths) fields, and policy support was likely.

Iris Pang, chief economist for Greater China at ING, said Xi’s remarks addressed “the urgent need for talent and promoting self-sufficiency in technological advancement”.

“We believe that this echoes to the US’s CHIPS Act,” Pang said, referring to the US regulations. “As such research spending on semiconductor technology should increase. Typically, policies are released after such important events in China.”

But the most interesting comments came from Tianfeng Securities analysts Song Xuetao and Zhang Wei, who noted on Monday that Xi in his speech called for China to “build a completely new national-led system”, for technology – a step away from what he said in 2017, which was urging citizens to build a system for technology innovation that was “enterprise-based” and “market-based”.

For the chip sector in particular, “there may be a major model change in the future, from market-driven to national capital driven,” they said in a research report.

ALSO SEE:

TSMC, Samsung Win Waivers; US Workers Ban Rocks China Firms

China’s ‘Breakthroughs’, Failures

In his speech, Xi listed a slew of industries where he described China as having achieved breakthroughs over the past decade, including large aircraft, space flight, satellite navigation – all of which rely on copious state support.

No mention was made of semiconductors, although this is an area where China has funnelled billions of dollars in funds but has also given more leeway in using market-led approaches versus other sectors.

Some, obviously believe that is set to change.

Venture capital (VC) has been allowed to invest in Chinese chip companies, with such firms receiving over $30 billion in VC cash between 2020-2021, according to Chinese investment research firm CVInfo.

State-backed chip companies are also free to buy and sell goods and supplies according to market demand, in competition with foreign products.

But while the support has propelled the rise of potential giants like Semiconductor Manufacturing International Corp and Yangtze Memory Technologies Co, no domestic Chinese chip company has gained global dominance at the most advanced level, and the sector remains heavily reliant on foreign technology.

The sector has also seen reports of graft and some very expensive failures.

In 2017, the local government in Wuhan and investors in Beijing placed tens of billions of yuan in Wuhan Hongxin Semiconductor Manufacturing, a chip fab that promised to produce 30,000 wafers per month, only to see it shutter in 2021 due to financial issues.

In the run up to the congress, a number of people affiliated with China’s national chip fund, which has raised 342.7 billion yuan ($47.6 billion) so far, were placed under investigation for corruption, raising speculation over the entity’s future.

On Monday, shares in Chinese information technology companies rose more than 1%, while semiconductor stocks rose 0.7%, a subdued reaction which suggests concern that US chip sector restrictions could stymie the sector’s progress in the short term, and perhaps, uncertainty on whether a new approach by Beijing will achieve the result that President Xi dearly desires.

- Reuters with additional editing by Jim Pollard

NOTE: This report was edited for greater clarity on Tuesday October 18, 2022.

ALSO SEE:

ASML and Lam Research Pull US Engineers Out in China – SCMP

KLA Seen Ending Dealings With China After US Chip Curbs

China’s Chip Industry Faces Deep Pain From US Curbs – FT

US, Japan Chips Alliance Aims to Thwart China Ambitions

China Gives Up On $20bn Wuhan Chipmaking Fiasco